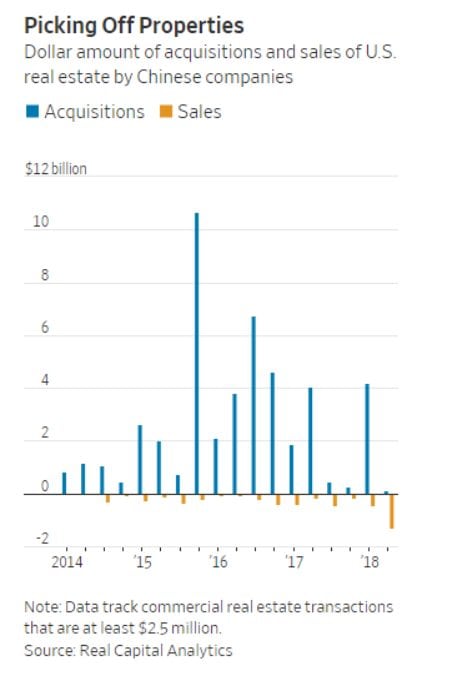

During the 2nd quarter of 2018, Chinese investors sold nearly $1.3 billion worth of commercial real estate in the U.S. while buying only $126 million in property.

This net negative sales figure of nearly $1.2 billion marks the first time since the onset of the Global Financial Crisis in 2008 that real estate investors from China sold more U.S. real estate than they purchased.

Buy Low, Sell High

Shortly after the GFC in 2008, Beijing gave the go-ahead for commercial real estate investors in China to buy outside of their country.

With the green light from Beijing, trophy properties in Los Angeles, San Francisco, New York, and Chicago were quickly snatched up.

At the peak of the Chinese acquisition wave, the Waldorf Astoria sold for $1.95 billion, marking the highest price ever paid for a hotel in the U.S.

During the same period, the Baccarat Hotel in Midtown Manhattan was purchased for about $230 million. With a sales price of $2 million per hotel room, the transaction marked one of the highest valuations for a hotel.

What Beijing Wants, Beijing Gets

After buying literally billions and billions of dollars of commercial real estate in the U.S., Beijing has now begun pressuring Chinese real estate investors to sell.

And what Beijing wants, Beijing gets. Three reasons for this about-face are:

Bad Debt Risk

Insurance companies and other Chinese-based institutional investors have accumulated enormous amounts of U.S. commercial real estate on their balance sheets. Now, Beijing is becoming concerned with an overweight exposure to potential bad debt in the U.S. real estate market.

Cashing In

Opportunistic selling is also taking place. After seeing commercial real estate values in the U.S. more than double since 2010, Chinese investors are turning equity into cash while they can.

Weak Yuan

The weakened yuan is also making U.S. commercial real estate less attractive to Chinese investors. In 2015, a Chinese commercial real estate investor would have paid 62.1 million yuan to purchase a $10 million property. Today, that same $10 million building would cost 68.4 million yuan, an increase of over 10%. (source)

Chinese Are Still Buying – Just Not in the USA

While the Chinese have become net sellers of commercial real estate in the U.S., they’ve become net buyers in other parts of the world.

According to a recent article in GB Times, Chinese overseas property investment hit a record high in 2017. Chinese real estate investors purchased nearly $40 billion in property outside of their country, an increase of 8% compared to 2016.

While investment in the U.S. property market decreased by about 64% year-over-year, investment in Asian markets increased by 34% and investment in European real estate soared by over 330%.

Although the U.S. commercial real estate market as a whole has fallen out of favor with Chinese investors, there are two asset classes where the Chinese are still buying.

A recent article in the Wall Street Journal notes that warehouses and senior living facilities are still attracting capital from Chinese commercial real estate investors.